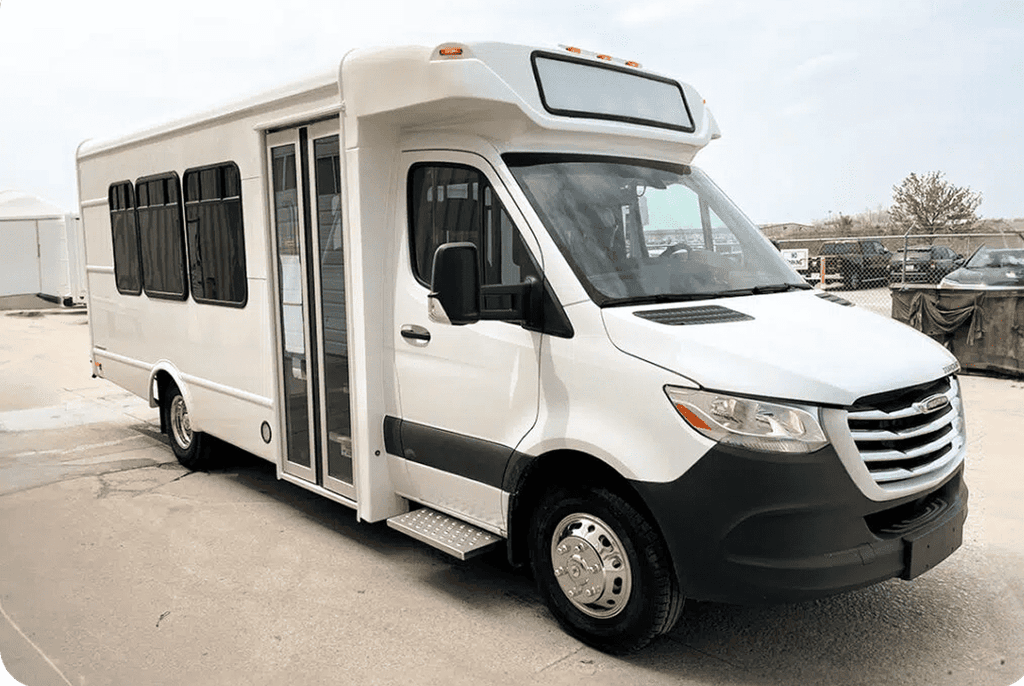

Buses For Sale in South Carolina

Used Bus For Sale, Near You

Enjoy transparent pricing and 24/7 customer support. Skip long wait times.

Browse Our South Carolina Inventory

Discover our complete selection of buses in South Carolina.

Loading buses...

Sell us your bus

We pay top-dollar for pre-owned school, passenger, and transit buses. No fleet is too big or too small.

Talk To Our Bus Experts

Buying a Bus in South Carolina

From smog compliance to DMV paperwork, buying a bus in South Carolina means checking off a few important boxes.

Insurance

- Minimum liability amounts: Varies by seat count, typically $300,000 for small busesPIP not required in South CarolinaDifferences for for-hire vs nonprofit operations: Nonprofits may have reduced ratesGroup policies available for churches/schools.

Bus Safety

- Inspection frequency: Annual inspections at licensed stationsRequired safety equipment: Seat belts, ADA lifts, emergency exitsSkoolie compliance: Must meet FMCSA standardsReference to federal standards: FMCSA, 49 CFR compliance required.

Perfect For

Our South Carolina inventory suits a wide range of users:

Schools, Colleges & Education

Fleet Operators & Tour Companies

Hotels, Airports & Corporate Shuttles

Frequently asked questions

What is the process for registering a bus in South Carolina?

Registering a bus in South Carolina involves completing the Application for South Carolina Title and Registration at your local DMV office. Having all necessary documents ready can make the process smoother. If you need assistance, the DMV staff can provide helpful guidance.

Is a CDL necessary for driving a bus in South Carolina?

Yes, a Commercial Driver's License (CDL) is required for buses that exceed 26,001 lbs or carry 16 or more passengers. This ensures drivers are equipped to handle larger vehicles safely. Local driving schools offer CDL training options that might be worth exploring.

Are emissions tests mandatory for buses in South Carolina?

Emissions testing is mandatory in Charleston County and surrounding areas to maintain air quality standards. Testing centers are available throughout these regions, and scheduling your test in advance can help avoid delays.

How can nonprofits benefit from tax exemptions in South Carolina?

Nonprofits can benefit from tax exemptions by providing IRS 501(c)(3) documentation. This can significantly reduce costs, allowing more resources to be directed towards your mission. Consulting with a tax professional can ensure all paperwork is correctly filed.

What Our Customers Say About Us

Proudly Part of

With decades of market expertise and facilitating thousands of sales, we are the go-to online bus marketplace. When you sell with us, you're partnering with a company that values credibility, efficiency, and your best interests.